Tax Cuts Defund the Very Things That Boost the Economy

After eight years of complaining about “Obama deficits,” Republicans are proposing huge, dramatic, unprecedented tax cuts, especially for corporations.

President Trump wants the corporate tax rate cut from 35 percent down to 15, denying the government $2 trillion of revenue over the next decade. He is also proposing dramatic cuts to personal income tax cuts that will especially benefit billionaires like him.

Republicans call corporate tax cuts “pro-growth,” saying they will give the economy a boost. Trump’s Treasury Secretary says the plan will “pay for itself with economic growth.”

So now they’re for “stimulus”?

But here’s the real question: do tax cuts actually boost economic growth?

What Tax Cuts Actually Do

In 2012, the Congressional Research Service looked at data from past tax cuts and the effect they had on the economy, and issued a report titled Taxes and the Economy: An Economic Analysis of the Top Tax Rates Since 1945. What did the study find?

There is not conclusive evidence, however, to substantiate a clear relationship between the 65-year steady reduction in the top tax rates and economic growth. Analysis of such data suggests the reduction in the top tax rates have had little association with saving, investment, or productivity growth. However, the top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution.

In fewer words: There is no evidence that tax cuts bring economic growth, but they do cause income to concentrate at the top.

That may sound bad, but, it’s even worse than that. Tax revenues build roads, bridges, airports, rail and and water systems. Taxes educate the population, conduct scientific research, run the courts, enforce regulations, standardize and enforce weights and measures, and about a million other things that make businesses prosper.

If you cut taxes, over time the business environment necessarily gets worse because those roads deteriorate, people are not as well educated, scientific research declines, courts clog up, regulation enforcement declines, along with about a million other things businesses rely on.

If you can’t get educated employees, can’t move goods on crowded and deteriorated roads and your competitors can get away with cheating, your business just isn’t going to do as well as it could.

Tax cuts defund all of those things that boost the economy and make our lives better. Over time the economy necessarily gets worse.

Are Taxes Theft?

Republicans say “taxes are theft.” They say “taxes take money out of the economy.” They say it “takes from those who work and earn and giving to those who don’t.” They say taxation “extracts wealth.”

The idea behind this pithy phrase is that government is illegitimate and “uses force’ to “take people’s money” so “they” can have it instead. They argue there are “producers” and “moochers” and the moochers outnumber the producers and take from them.

These are all actually arguments against democracy. Substitute the words “We the People” for the word “government” in their arguments and you’ll see how this works.

The “they” in their arguments isn’t some “other” person that grabs our money. It’s We the People.

The whole idea of democracy is that We the People govern ourselves, so we’re the ones who decide how to allocate the resources of our economy to make our lives better. How do we allocate our resources? We tax and spend.

Democracy is taxing and spending. And in a functioning democracy, we spend on things that make our lives better.

Are tax cuts theft? Or are they really about theft of democracy from We the People?

I explored the origins of this idea in my 2012 post, Tax Cuts Are Theft:

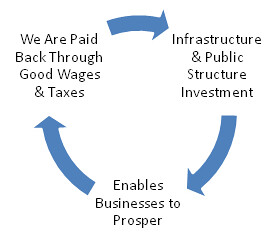

The American Social Contract: We, the People built our democracy and the empowerment and protections it bestows. We built the infrastructure, schools and all of the public structures, laws, courts, monetary system, etc. that enable enterprise to prosper. That prosperity is the bounty of our democracy and by contract it is supposed to be shared and reinvested. That is the contract. Our system enables some people to become wealthy but all of us are supposed to benefit from this system. Why else would We, the People have set up this system, if not for the benefit of We, the People?

… The American Social Contract is supposed to work like this:

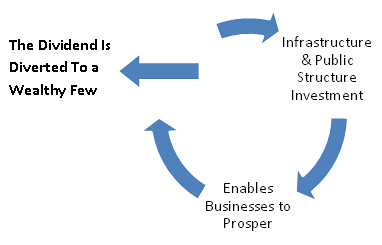

… But the “Reagan Revolution” broke the American Social Contract. Since Reagan, the system is working like this:

Tax cuts, like the ones Trump now proposes, eat the seed corn of our prosperity.

We’ve been down this road before. We shouldn’t fall for yet another Republican con, this time from the con-man in chief.

***

Reposted from Our Future.