New Anti-Inversion Rules Block Pfizer’s $35 Billion Tax Dodge

Giant, mega-profitable companies like the drug maker Pfizer engage in complicated, tricky schemes to dodge paying the taxes they owe. The result is that there is not enough money for bridge repair, better schools, and other public goods.

The Treasury Department caught up to Pfizer and others this week, issuing new rules that will help address the problem.

Those online petitions you signed and those letters and calls to members of Congress helped make this happen. They put pressure on those responsible for fixing this, and they responded.

“A Merger Of False Desire And False Beauty”

November’s post, “Pfizer Buying Allergan So It Can Pretend To Be Irish In Tax Scam,” explained Pfizer’s latest tax-avoidance scheme:

The pharmaceutical corporation Pfizer will acquire pharmaceutical corporation Allergan in a deal valued at $160 billion. My colleague Richard Eskow called this combination of Pfizer (the maker of Viagra) and Allergan (the maker of Botox) “a merger of false desire and false beauty.”

More to the point, this deal is structured as an “inversion” designed to dodge U.S. taxes. Allergan (itself the product of a similar inversion) is headquartered in New Jersey but for tax reasons is incorporated in Ireland – a tax haven. After the acquisition, Pfizer will keep its headquarters in New York but change its corporate address to Ireland.

In other words, the resulting merged company will make and sell products in the same places it makes and sells them now. The same executives will occupy the same buildings. It will receive the same taxpayer-funded U.S. services, infrastructure, courts and military protection that it receives now. But the company will now claim it is “based” in tax-haven Ireland and thereby dodge U.S. taxation.

To recap: Pfizer and Allergan merge, pretend to be “Irish” but stay where they are in the U.S., sell the same stuff in the same outlets, but dodge their taxes. We lose out on schools, bridge repair, and other government services.

Pfizer has used tax deferral, earnings stripping and “inversion” to dodge taxes.

● Tax deferral is a loophole that allows companies to defer paying taxes on profits made outside the U.S. until they “bring the money home.” Pfizer has around $150 billion stashed outside the U.S., on which they owe about $35 billion in taxes.

● Earnings stripping is when a foreign subsidiary loans huge amounts of money to the U.S. parent (instead of the parent just “bringing the money home”), and charges interest, which happens to be deductible from any U.S. taxes owed.

● Inversion is the scheme of merging with a non-U.S. company, then pretending you are no longer a U.S. company even though your headquarters and everything else remains in the U.S. exactly as it was. Pfizer is trying to use this to avoid ever paying the $35 billion they owe in taxes on already booked profits the company has stashed outside the U.S.

Treasury Department’s New Rules

The Obama Treasury Department issued more than 300 pages of new regulations aimed at stopping these tax schemes. President Obama underscored the importance of the new rules in a short White House speech. “When companies exploit loopholes like this, it makes it harder for America to invest in the things that will make America’s economy going strong for future generations,” he said. “It sticks the rest of us with the tab, and it makes hard-working Americans feel like the deck is stacked against them.”

The new regulations crack down on earnings-stripping loans if they don’t finance actual investment, prevent overseas companies that are already inverted from taking part in new inversions, and allow the IRS when auditing to divide a purported debt instrument into part debt and part stock. (The latter addresses an “ownership share” provision in determining whether inversions create a non-U.S. company. Pfizer had claimed shareholders would own 56 percent of the new company – just below the 60 percent threshold that the Treasury Department set in 2014. Now Pfizer shareholders will own 70 percent and no longer qualify for tax breaks.)

A Treasury Department fact sheet explains how they go after the complicated scheme Pfizer and other companies used to dodge taxes.

The Wall Street Journal, in “New Rules on Tax Inversions Threaten Pfizer-Allergan Deal,” quotes Robert Willens, a New York-based tax analyst, in saying that the rules are going to be a “major impediment” in the way of Pfizer pulling off this inversion scheme. “They’re pretty much taking all of the juice out of inversions,” Willens told the Journal. “They’ve addressed literally every benefit that one attempted to gain from an inversion and shut them all down systematically.”

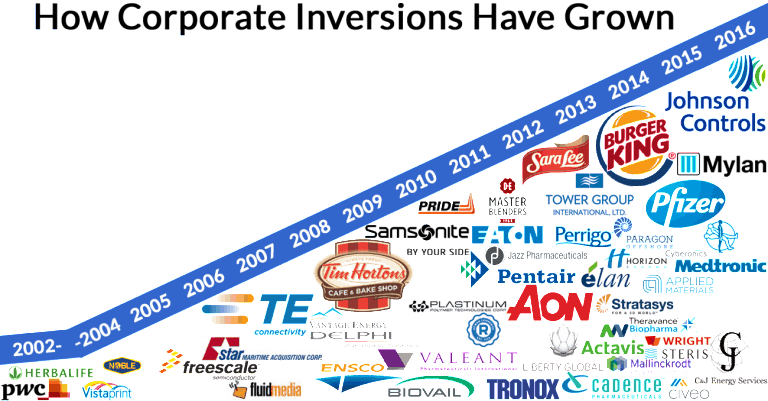

Frank Clemente, executive director of Americans for Tax Fairness, made the following statement in response. (Click through for full statement and scroll down to see an amazing chart showing the timeline of Pfizer tax-dodging schemes.)

“Pfizer cleverly structured its inversion with Allergan so that it would not be considered an inversion, allowing it to receive all the tax breaks that corporate deserters get when they change their legal address to a tax haven.

“Fortunately, it appears that the Treasury Department has issued a rule with respect to serial inverters, such as Allergan, that will wipe out the expected tax breaks Pfizer was counting on. Americans for Tax Fairness estimated those tax breaks on the company’s existing offshore profits to be as much as $35 billion.

“If our analysis is correct, this is a major victory for taxpayers who pay their fair share and who should expect no less from one of America’s biggest and most profitable corporations. It is also a credit to the Treasury Department for closing this so-called ‘hopscotch loan’ loophole for serial inverters. We hope that Treasury goes further in the future and closes this loophole for all companies once and for all.

A Step But Only A Step

This effort by the Obama administration is a step toward blocking some of the complicated schemes companies like Pfizer use to avoid paying the taxes they owe. But it is only a step.

In a statement Tuesday, Obama asked Congress to fix other loopholes that allow companies to dodge as much as $620 billion they owe on more than $2.2 trillion of profits they have pretended were made outside the U.S. but not yet brought home. “Only Congress can close it for good. And only Congress can make sure that all the other loopholes that are being taken advantage of are closed,” Obama said.

***

This has been reposted from the Campaign for America's Future.