Six Essential Facts in Focus : Prep for Chinese President Xi’s State Visit

All eyes will be on the White House this week when China’s President arrives for an official state visit. According to Pew Research, Americans are increasingly concerned about issues stemming from the rise of China — including holdings of U.S. debt, our surging bilateral trade deficit, government-sponsored cyberattacks, persistent human rights violations, rampant environmental corruption, and a startling military buildup. With anxieties over China’s state-driven economic policies at an all-time high, the Alliance for American Manufacturing outlines the economic issues you need to know about as the two Presidents meet.

China remains a state-controlled, non-market economy. This summer Americans experienced first-hand how the Chinese government’s economic interventions distort the global economy and threaten our financial well-being. Many Americans saw their retirement plans take a rollercoaster ride as the Chinese central bank awkwardly and repeatedly intervened in an attempt to stabilize the Shanghai Stock Exchange. China’s state-dominated financial system carries out the policies of Beijing and serves as the instrument for targeted investments in strategic industrial sectors. According to the Center for American Progress, “State-owned banks control 57 percent of China’s banking-sector assets, and state-owned enterprises account for more than 90 percent of the capital raised in China’s corporate bond market.” Let there be no doubt: China is not a market economy and has a long way to go before it can be granted any new preferential treatment to the U.S. market — including a pending 2016 decision by the Commerce Department as to whether China has successfully transitioned to “market economy” status. If President Xi simply rehashes China’s stated commitment to shed its state-owned enterprises and permit more private market influence, American workers and industry will continue to be shortchanged. America’s patience with China’s export-led mercantilism is running short, and China must face economic consequences for its longstanding failure to comply with its international commitments.

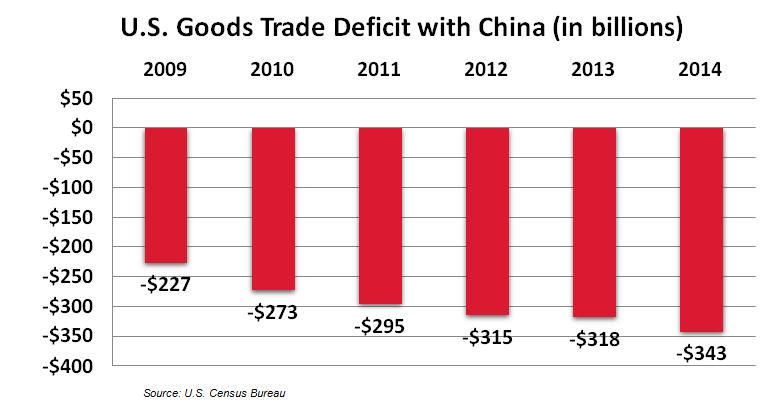

U.S. Goods Trade Deficit with China (in billions)

Source: U.S. Census Bureau

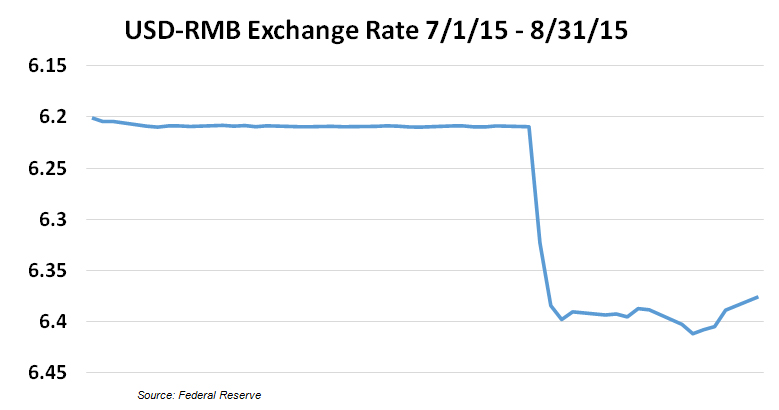

China continues to manipulate its currency. Following China’s recent stock market meltdown, the People’s Bank of China hastily devalued its currency by four percent, erasing three years of very modest appreciation against the dollar. It also marked another embarrassing setback for the Obama administration’s approach to this issue; the Treasury Department has declined to name China a currency manipulator on 13 consecutive occasions. Beijing has a long history of currency manipulation, which allows it to boost exports by making them artificially cheaper. The results have been devastating for American workers, with the loss of 3.2 million jobs stemming from massive and growing bilateral trade deficits — which hit a record $342 billion in 2014. Despite renewing past promises to move to a more transparent and market- determined exchange rate system at the June 2015 Strategic and Economic Dialogue (S&ED), China continues to demonstrate that it will do whatever is in its own interests as long as there are no consequences. Without the threat of real, actionable penalties sought by a bipartisan majority on Capitol Hill, few believe that China will end its currency manipulation anytime soon.

Source: Federal Reserve

China is ramping up production regardless of demand. China’s massive and growing overcapacity in 19 industrial sectors is flooding global markets with cheap steel, tires, paper, aluminum, glass, solar panels and other products. Even as China’s economy slows, its state- owned and state-controlled companies continue to ramp up production, depressing growth and eliminating jobs in the United States. For example, UBS estimates that there are 553 million tons of excess global steel capacity, with China the leading contributor. Meanwhile, the U.S. steel industry — which produced under 90 million tons in 2014 — is currently operating at just 71 percent of capacity and has experienced devastating layoffs this year. Overcapacity has been raised with China at past dialogues, but there is no framework of accountability nor any rules in place to push China to pursue growth based on domestic consumption rather than exports. Left unchecked, China’s factory capacity expansions and overcapacity exports to the United States will persist.

Despite failed commitments, bilateral investment treaty (BIT) negotiations proceed. In the nearly 15 years since China gained access to the World Trade Organization (WTO), Beijing has repeatedly disregarded the rules of international trade to boost its own economy at the expense of others. Hopes that increased engagement with the state-controlled economy would yield market-driven reforms resulting in greater access to its 1.3 billion consumers have largely fallen flat. In many cases, China has actually reverted to greater protectionism and increased state- control, as evidenced by its recent financial market interventions, currency manipulation, indigenous innovation policies, and anti-monopoly law. China has repeatedly demonstrated that it will do whatever is in its own interests regardless of any commitments it may have made. This is why the prospect of inking a new U.S.-China Bilateral Investment Treaty (BIT) should raise real concerns. Yes, we should be pushing China to make necessary reforms so that U.S. companies can operate on a level playing field with China. However, it is a losing proposition to offer expanded access to the U.S. market so China’s state-owned enterprises can go on a shopping spree for U.S. companies in exchange for yet another “promise” of greater access to the Chinese market. Chinese investment in the United States already outpaces U.S. investments in China. We should make the investment climate here more desirable for domestic firms rather than promoting their moves to China. Negotiations on a BIT should not proceed until China initiates serious and sustained market reforms.

China hacks U.S. companies for trade secrets. Government-backed cyber hackers in China are stealing sensitive data from American companies, leading to an uptick of FBI and Justice Department investigations. Economic espionage originating in China is the source 95 percent of all economic espionage cases, resulting in the loss of hundreds of billions of dollars to the U.S. economy and untold jobs. Even the administration fell victim this summer, though it has thus far declined to impose sanctions. As the state visit approaches, we will be watching to see if the President outlines consequences for Beijing’s cyberespionage.

China’s military buildup is supported by its economic policies. A massive trade surplus with the United States, fueled by currency manipulation and other predatory trade practices, has enabled China’s military buildup and eroded our defense industrial base. IHS projects Beijing’s defense spending to soar to $260 billion by 2020 — a 100 percent increase since 2010. Meanwhiile, China’s predatory economic policies have contributed to a disturbing trend of outsourcing key sectors of the U.S. defense industrial base that has increased our reliance on a potentially hostile trading partner for our own national security. Already, the United States relies on China and other nations for hi-tech magnets needed for helicopters, tanks, and subs; lithium- ion batteries used in drones; semiconductors used in satellites and missile guidance systems; rare earth elements used in night-vision devices; and military communications systems critical for battlefield operation. Strengthening the U.S. defense industrial base must be a priority, starting with ensuring a level playing field for American manufacturing. Potential supply chain disruptions due to encounters in the South China Sea, political conflict, or price manipulation could put America in a perilous situation.

***

Post courtesy of the Alliance for American Manufacturing.